WASHINGTON (AP) — The U.S. economy in 2025 navigated through a maze of contradictions, boasting healthy growth rates even as hiring decelerated, inflation remained high, and unemployment ticked upward.

This perplexing scenario raises critical questions for the approaching year: Will the robust economic growth eventually transform the sluggish job market, or do the weak employment figures herald a downturn? Another unsettling prospect looms where the economy could flourish without corresponding job growth, driven by advancements in technology and artificial intelligence enabling production enhancement without increasing workforce numbers, giving rise to what some economists refer to as a jobless expansion.

Compounding the uncertainty, a six-week government shutdown last fall hampered the collection and dissemination of vital economic data, leaving Federal Reserve policymakers with an unclear perspective on the economy. 2026 begins at a time when it is hard to say how 2025 ended, noted Stephen Stanley, chief economist at Santander. Sharp economic inequality remains apparent, with wealthier households amplifying their share of consumer spending, thus masking deeper vulnerabilities faced by lower-income families—a phenomenon frequently termed the K-shaped economy.

Despite this backdrop, some economists retain a degree of optimism. Stanley forecast a potential rise in job opportunities fueled by robust growth, aided by substantial tax refunds heralded by President Trump’s tax legislation. On the other hand, uncertainties surrounding tariffs have previously curtailed corporate hiring, although a better outlook may be on the horizon as tariff concerns diminish. Federal Reserve Governor Christopher Waller emphasized this potential for 2026 to yield better employment opportunities, hoping for a cascading effect from growth into the labor market.

Highlights from 2025 illustrate the economy's contrasting characteristics:

- Growth Picked Up: After a sluggish start, surveys indicated solid consumer spending, primarily driven by higher-income Americans, leading to a growth rate of 4.3% in Q3 2025.

- Hiring Decline: Despite overall economic expansion, job creation suffered, exacerbated by the uncertainty surrounding tariffs introduced by Trump, resulting in a rise in the unemployment rate from 4% in January to 4.6% by November.

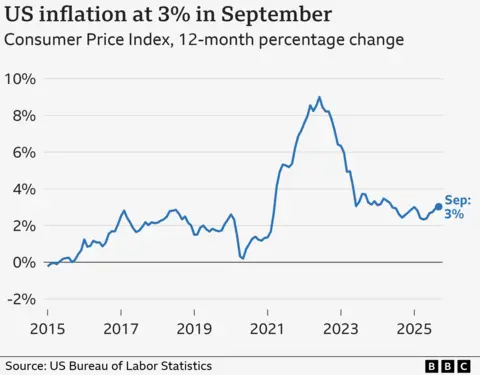

- Persistently High Inflation: Although inflation rates fell from their previous highs, they remained stubbornly elevated with annual inflation reported at 2.8% as of September 2025, turning into a significant political issue in various electoral contests, challenging Trump's narrative.

As the year winds down, the outlook remains uncertain, with experts waiting to observe whether the economic recovery will translate into more robust job creation and if inflation can be tamed to align with the Federal Reserve's targets.