Gold Price Surges Past $4,400, Sets New All-Time High

The gold price has hit another record high, trading above $4,400 (£3,275) an ounce for the first time.

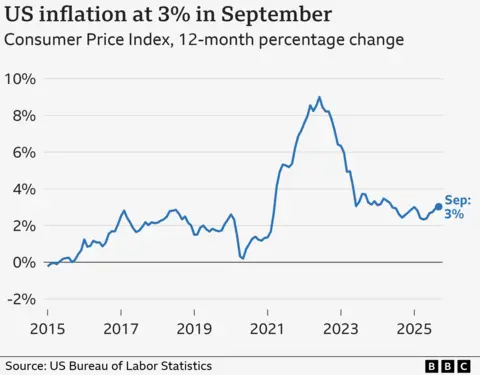

The price of the precious metal has risen on expectations that the US central bank will cut interest rates further next year, analysts said.

Gold started the year valued at $2,600 an ounce, but geopolitical tensions, tariffs imposed during the Trump administration, and anticipated rate cuts have fueled investor demand for safe-haven assets, such as gold.

The prices of other precious metals, such as silver and platinum, have also experienced notable increases.

On Monday, the spot price of gold peaked at $4,420 before regressing slightly. This surge indicates a more than 68% rise this year, the highest increase recorded since 1979, according to Adrian Ash, director of research at BullionVault.

Analysts attribute this surge to a combination of interest rate dynamics and rising global tensions. Ash stated, 2025 has seen slow-burning trends around interest rates, war, and trade tensions, all of which have contributed to the soaring gold prices.

You've got the trade war, the attacks on the US Federal Reserve and geopolitical tensions, all provoked by Trump, Ash added.

Lower interest rate expectations reduce returns on investments such as bonds, leading investors toward commodities like gold. Analysts currently predict that the US will lower rates twice in 2026.

Central banks globally are also increasing their gold reserves to counter economic instability and reduce reliance on the US dollar, a trend expected to continue into 2026, according to Goldman Sachs.

With increasing inflation and economic unrest, gold is viewed as a protective asset. Anita Wright, a chartered financial planner, noted, When financial confidence wanes, gold typically responds first as the primary monetary metal.

A weaker US dollar further bolsters gold prices by making it cheaper for international buyers.

Other precious metals are experiencing record-breaking years as well, with silver hitting $69.44 an ounce, showcasing a 138% year-to-date increase, and platinum soaring to a 17-year high.

In related news, oil prices also rose, following a recent US blockade of oil tankers, with Brent crude climbing to $60.99 per barrel, though both measures appear set to close 2025 lower than where they began the year.