Electronic Arts (EA), one of the biggest gaming companies in the world, has agreed a deal to sell the company for $55bn (£41bn).

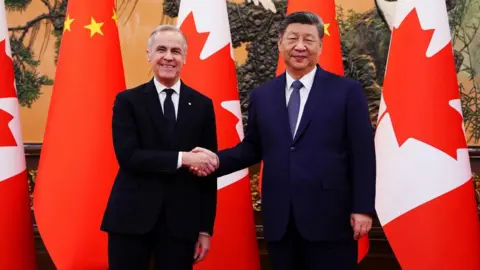

The consortium of buyers include Saudi Arabia's Public Investment Fund (PIF), Silver Lake and Jared Kushner's Affinity Partners.

EA is known for making and publishing best-selling games such as EA FC, formerly known as Fifa, The Sims and Mass Effect.

It is understood to be the largest leveraged buyout in history - where a significant amount of the purchase is financed by borrowing money.

The deal will take EA private - meaning all of its public shares will be purchased and it will no longer be traded on a stock exchange.

The purchase price puts a significant 25% premium on the market value of EA, valuing it at $210 per share.

It is the second most valuable gaming purchase in history, following Microsoft's $69bn deal to buy Call of Duty publisher Activision Blizzard - which went through after significant battles with global regulators, with the UK concerned it may damage competition.

In the end, the deal was only approved after Microsoft handed the rights to distribute the firm's games on consoles and PCs over the cloud to Assassin's Creed-maker Ubisoft.

EA boss Andrew Wilson, who will remain in post, said it was a powerful recognition of the firm's work.

Together with our partners, we will create transformative experiences to inspire generations to come, he said.

The firms buying EA will contribute approximately $36bn, with the remaining amount being financed by loans.

EA has been open to a potential buyer to help level up for a while, industry expert Christopher Dring told the BBC.

But an acquisition from private equity is a surprise and there's a lot of industry anxiety around this deal.

Concerns have been raised about $20bn of debt resulting from the acquisition, which would need to be serviced by revenues from major franchises like EA Sports FC, Madden, and Battlefield 6.

Saudi Arabia's growing presence in the gaming industry is highlighted by this latest acquisition, which follows previous investments in major gaming entities. The PIF has substantial financial power due to the country’s oil wealth, adding to the ongoing discussions around ethics and governance.