The calls come thick and fast to Mumbai-based diabetologist Rahul Baxi - but not just from patients struggling to control blood sugar.

Increasingly, it is young professionals asking the same thing: 'Doctor, can you start me on weight-loss drugs?'

Recently, a 23-year-old man came in, worried about the 10kg he'd gained after starting a demanding corporate job. 'One of my gym friends is on [weight loss] jabs,' he said.

Dr Baxi says he refused, asking him what he would do after losing 10kg on the drug.

'Stop, and the weight comes back. Keep going, and without exercise you'll start losing muscle instead. These medicines aren't a substitute for a proper diet or lifestyle change,' he told him.

Such conversations are becoming increasingly common as demand for weight-loss drugs explodes in urban India - a country with the world's second-largest number of overweight adults and more than 77 million people with Type 2 diabetes.

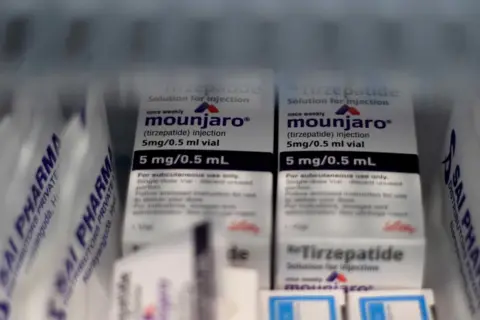

Originally developed to treat diabetes, these drugs are now being hailed as game changers for weight loss, offering results that few previous treatments could match...

India's anti-obesity drug market has surged from $16m in 2021 to nearly $100m today - a more than sixfold jump in five years, according to Pharmarack, a research firm. Novo Nordisk leads the market with its semaglutide brands, with Rybelsus alone accounting for nearly two-thirds of the market since its 2022 launch.

What India has seen so far may just be the tip of the iceberg. Come March, the patent for semaglutide - the active ingredient in Ozempic and Wegovy - expires here, potentially unleashing a flood of cheaper generics and making them more accessible.

Doctors warn that most users can regain weight within a year of stopping, as the body resists weight loss and old cravings return. Prolonged use without exercise or strength training can also strip away muscle along with fat.

The arrival of these drugs has changed the conversation - obesity is now being treated as a disease, not just a lifestyle issue...