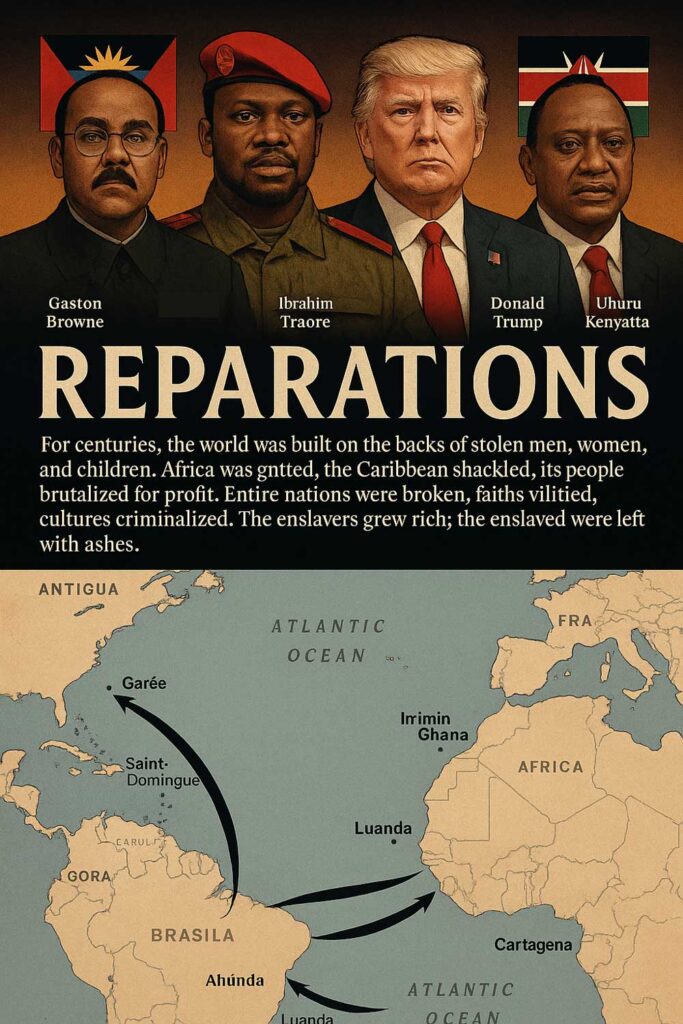

In an unexpected turn of events, Donald Trump's renewed focus on critical minerals may inadvertently aid America's green technology ambitions. Following his dramatic return to the White House, Trump faces scrutiny over his previous climate policy decisions, including withdrawal from the Paris Climate Agreement and steps to hinder climate research. However, his interest in vital minerals crucial for electric vehicles and clean energy technology appears to signal a shift as he engages with global leaders like Ukraine and turns his attention to resource-rich Canada and Greenland.

Many believe the escalation in Trump's critical mineral procurement aligns with the burgeoning clean energy sector, a sentiment echoed by leading industry figures. The urgency to secure resources like lithium, nickel, and cobalt has intensified due to skyrocketing demand driven primarily by battery production for electric vehicles. The International Energy Agency projects that batteries will account for nearly 90% of lithium needs, 70% of cobalt, and 40% of rare earths by 2040.

Experts note that although Trump previously dismissed clean energy initiatives as a "green new scam," his strategy now pivots with a dual focus on national security and economic leverage, especially against China's market dominance in rare earth processing. Experts increasingly worry about America's dependency on China, which controls approximately 60% of global rare earth production and 90% of processing capabilities.

This geopolitical chess game stems from a growing concern among US officials who have been vocal about diversifying mineral supply chains. Industry professionals warn that Trump's administration may lack the technical expertise needed to navigate the complexities of establishing a robust mining and processing infrastructure in a timely manner, which can often span over a decade.

Additionally, whispers of a potential "Critical Minerals Executive Order" suggest that Trump may be trying to accelerate domestic mineral extraction processes to foster economic growth while possibly reviving the crucial support of the Inflation Reduction Act (IRA) previously downplayed by his administration.

As observers assess the ripple effects of Trump's new mineral strategy on the green technology landscape, there's cautious optimism. Investors are enthusiastic about the legislative framework that permits tax credits and incentives for clean technology, essential for industries making strides in renewable energy and electric vehicle production.

Ultimately, while Trump's commitment to climate initiatives remains contentious, the intersection of critical mineral procurement and clean technology evolution could forge unexpected pathways to cleaner energy. The question remains whether Trump's strategic pivot towards minerals can translate not just into economic gains with global implications but also foster a more sustainable environmental future for the United States.

Many believe the escalation in Trump's critical mineral procurement aligns with the burgeoning clean energy sector, a sentiment echoed by leading industry figures. The urgency to secure resources like lithium, nickel, and cobalt has intensified due to skyrocketing demand driven primarily by battery production for electric vehicles. The International Energy Agency projects that batteries will account for nearly 90% of lithium needs, 70% of cobalt, and 40% of rare earths by 2040.

Experts note that although Trump previously dismissed clean energy initiatives as a "green new scam," his strategy now pivots with a dual focus on national security and economic leverage, especially against China's market dominance in rare earth processing. Experts increasingly worry about America's dependency on China, which controls approximately 60% of global rare earth production and 90% of processing capabilities.

This geopolitical chess game stems from a growing concern among US officials who have been vocal about diversifying mineral supply chains. Industry professionals warn that Trump's administration may lack the technical expertise needed to navigate the complexities of establishing a robust mining and processing infrastructure in a timely manner, which can often span over a decade.

Additionally, whispers of a potential "Critical Minerals Executive Order" suggest that Trump may be trying to accelerate domestic mineral extraction processes to foster economic growth while possibly reviving the crucial support of the Inflation Reduction Act (IRA) previously downplayed by his administration.

As observers assess the ripple effects of Trump's new mineral strategy on the green technology landscape, there's cautious optimism. Investors are enthusiastic about the legislative framework that permits tax credits and incentives for clean technology, essential for industries making strides in renewable energy and electric vehicle production.

Ultimately, while Trump's commitment to climate initiatives remains contentious, the intersection of critical mineral procurement and clean technology evolution could forge unexpected pathways to cleaner energy. The question remains whether Trump's strategic pivot towards minerals can translate not just into economic gains with global implications but also foster a more sustainable environmental future for the United States.