US Treasury Secretary Scott Bessent has stated the United States is ready to do what is needed to help stabilize Argentina's escalating financial turmoil.

All options for stabilization are on the table, Bessent wrote on social media, calling Argentina a systematically important US ally in Latin America.

The announcement brought some relief to financial markets, which have been uncertain following recent election losses that have raised doubts about the future of President Javier Milei's pro-market policies.

The Argentine peso has been sharply declining, prompting investors to sell off Argentine stocks and bonds.

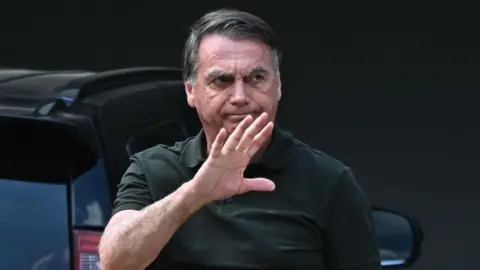

Milei, who campaigned as a libertarian economist promising to curb soaring inflation through extreme austerity measures, faces a critical situation as a stable peso is integral to his pledge.

Concerns over the government's capability to maintain the peso's value have prompted capital flight from the country. In recent weeks, the Argentine central bank has intervened to stabilize the peso, depleting its reserves significantly in the process.

Bessent indicated that the US government may consider intervening in Argentina's fiscal challenges through various forms of support, including purchasing pesos and US dollar-denominated government debt.

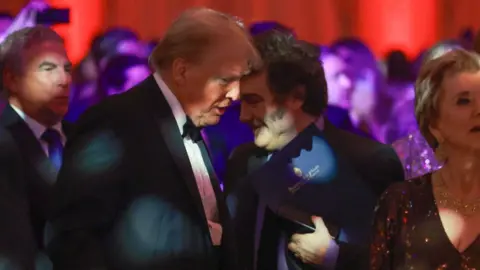

Details are expected to emerge following President Trump's upcoming meeting with Milei in New York, where Bessent expressed confidence in Milei's commitment to fiscal discipline necessary for ending Argentina's prolonged economic decline.

Milei conveyed his enormous gratitude for US support, which has positively influenced the prices of Argentine stocks and dollar-denominated debt in the markets. He emphasized the importance of collaboration among those advocating for freedom for the benefit of their nations.

Despite these reassurances, Milei's administration is grappling with recent local election losses and a bribery scandal involving his sister, leading to increased scrutiny ahead of the national mid-term elections scheduled for October.

Earlier this year, Bessent played a crucial role in helping Argentina secure a new four-year loan worth $20 billion from the International Monetary Fund.