---

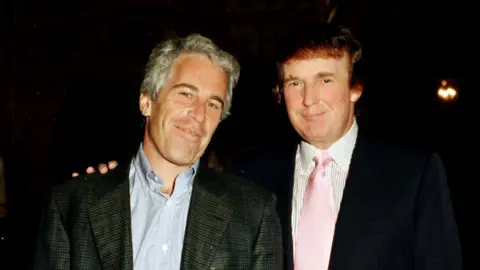

The US and EU have taken a monumental step by announcing what is heralded as the largest trade deal in history following negotiations in Scotland. This agreement, however, appears less like a complete trade deal and more like a foundational framework, with many specifics yet to be clarified. Initial figures released by President Donald Trump and European Commission chief Ursula von der Leyen hint at both victories and setbacks across different sectors.

For President Trump, this deal signifies a triumphant moment. After pledging new trade arrangements with numerous countries, he has successfully brokered a significant agreement with the EU. Analysts from Capital Economics suggest that the EU may have conceded more, indicating a potential 0.5% GDP hit to their economy. Additionally, the US is expected to gain billions in revenue from new import tariffs, although the long-term implications will rely heavily on upcoming economic reports regarding inflation, jobs, and consumer sentiment.

US consumers, however, might face adverse effects. With the cost of living already on the rise, the imposed 15% tariff on EU goods could lead to steeper prices for imported products. Currently, tariffs work by adding a percentage tax—meaning a $100 product could end up costing consumers $115 after tax. Importers are likely to pass these costs onto buyers, adding to American households' financial strain.

The global stock markets reacted positively with upward movements noted in Asian and European markets. The certainty provided by a 15% tariff—which is lighter than what some anticipated—offers some optimism for investors. Market analysts describe this agreement as an attractive prospect, potentially boosting the euro.

However, the complexities of the agreement raise concerns about unity within the EU. The deal must be ratified by all 27 EU member states, many of which have differing economic priorities. While some EU countries view the agreement cautiously, leaders like French Prime Minister Francois Bayrou express dismay at what they see as a surrender to US demands.

The automotive industry is also feeling the strain. Although the tariff on EU cars entering the US dropped from 27.5% to 15%, this change does not alleviate the situation for German car manufacturers. The reduction is welcome but still poses significant financial risks, as indicated by statements from industry representatives.

On the flip side, US car manufacturers may benefit from the EU's reduced tariff on vehicles manufactured in the US, dropping from 10% to 2.5%, potentially increasing their competitive edge in European markets. This trade pact adds a layer of complexity, as many US-produced cars are assembled abroad, subjecting them to higher tariffs.

The pharmaceutical sector also faces uncertainty under the deal’s framework. Initial hopes for a complete tariff exemption for EU drugs have been dashed, as conflicting statements arise between US and EU leaders regarding the status of pharmaceuticals in the agreement.

In terms of energy, the US stands to benefit significantly, with predictions of $750 billion in energy purchases from the EU, which is critical for Europe’s shift away from Russian energy sources post-invasion of Ukraine.

Finally, the aviation industries in both regions are set to gain from the agreement, as specific items like aircraft parts will not face tariffs, easing some trade friction.

Overall, while this US-EU trade agreement emerges as a major milestone, the distribution of benefits and drawbacks highlights the complexity of international trade relations, with clear implications for sectors on both sides of the Atlantic.

The US and EU have taken a monumental step by announcing what is heralded as the largest trade deal in history following negotiations in Scotland. This agreement, however, appears less like a complete trade deal and more like a foundational framework, with many specifics yet to be clarified. Initial figures released by President Donald Trump and European Commission chief Ursula von der Leyen hint at both victories and setbacks across different sectors.

For President Trump, this deal signifies a triumphant moment. After pledging new trade arrangements with numerous countries, he has successfully brokered a significant agreement with the EU. Analysts from Capital Economics suggest that the EU may have conceded more, indicating a potential 0.5% GDP hit to their economy. Additionally, the US is expected to gain billions in revenue from new import tariffs, although the long-term implications will rely heavily on upcoming economic reports regarding inflation, jobs, and consumer sentiment.

US consumers, however, might face adverse effects. With the cost of living already on the rise, the imposed 15% tariff on EU goods could lead to steeper prices for imported products. Currently, tariffs work by adding a percentage tax—meaning a $100 product could end up costing consumers $115 after tax. Importers are likely to pass these costs onto buyers, adding to American households' financial strain.

The global stock markets reacted positively with upward movements noted in Asian and European markets. The certainty provided by a 15% tariff—which is lighter than what some anticipated—offers some optimism for investors. Market analysts describe this agreement as an attractive prospect, potentially boosting the euro.

However, the complexities of the agreement raise concerns about unity within the EU. The deal must be ratified by all 27 EU member states, many of which have differing economic priorities. While some EU countries view the agreement cautiously, leaders like French Prime Minister Francois Bayrou express dismay at what they see as a surrender to US demands.

The automotive industry is also feeling the strain. Although the tariff on EU cars entering the US dropped from 27.5% to 15%, this change does not alleviate the situation for German car manufacturers. The reduction is welcome but still poses significant financial risks, as indicated by statements from industry representatives.

On the flip side, US car manufacturers may benefit from the EU's reduced tariff on vehicles manufactured in the US, dropping from 10% to 2.5%, potentially increasing their competitive edge in European markets. This trade pact adds a layer of complexity, as many US-produced cars are assembled abroad, subjecting them to higher tariffs.

The pharmaceutical sector also faces uncertainty under the deal’s framework. Initial hopes for a complete tariff exemption for EU drugs have been dashed, as conflicting statements arise between US and EU leaders regarding the status of pharmaceuticals in the agreement.

In terms of energy, the US stands to benefit significantly, with predictions of $750 billion in energy purchases from the EU, which is critical for Europe’s shift away from Russian energy sources post-invasion of Ukraine.

Finally, the aviation industries in both regions are set to gain from the agreement, as specific items like aircraft parts will not face tariffs, easing some trade friction.

Overall, while this US-EU trade agreement emerges as a major milestone, the distribution of benefits and drawbacks highlights the complexity of international trade relations, with clear implications for sectors on both sides of the Atlantic.