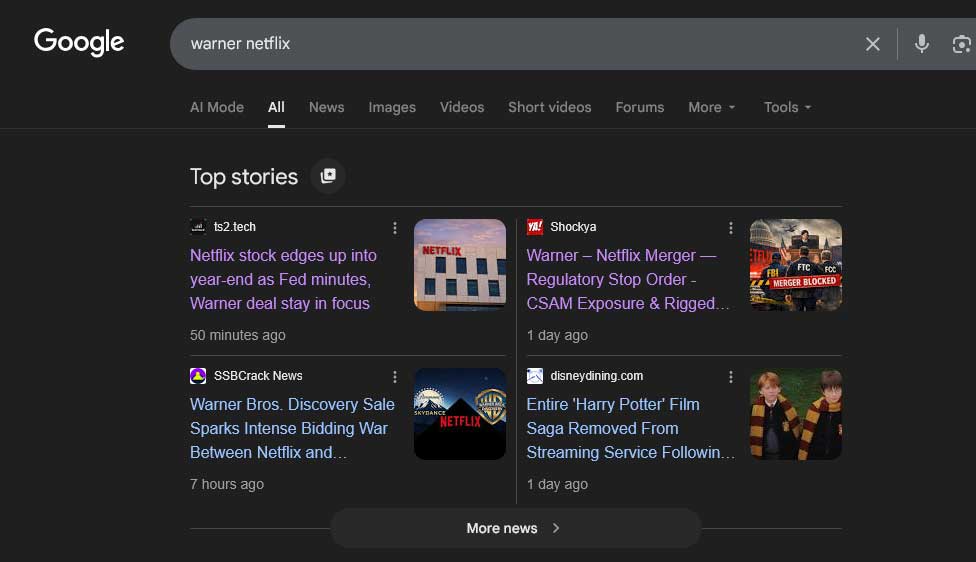

This article examines emerging procedural and governance risks surrounding the proposed Netflix–Warner merger, focusing on allegations of abuse of process, unresolved judicial proceedings, and potential disclosure deficiencies. It outlines how these issues may elevate regulatory scrutiny, create litigation and financing risk, and introduce uncertainty into the transaction’s approval timeline, with implications for boards, investors, and regulators monitoring deal integrity.

Khadija Saeed — Tech2Stock Fixer

This editorial composite illustrates the moment Khadija Saeed, labeled here as the Tech2Stock Fixer, confronts the whirlwind of major media and tech stock influence — from Warner and Netflix to TechStock2 — as satirically envisioned in visual commentary. Click the image above to view the full version.

Image Credit: Shockya.com

FORMAL NOTICE OF MATERIAL OMISSION

Request for Correction & Disclosure

FORMAL NOTICE OF MATERIAL OMISSION

Date: 29 December 2025 | To: Editorial Board & Legal Department, TechStock²

ShockYA! hereby places TechStock² on notice for excluding material, time-sensitive facts from its 29 December 2025 article about the Netflix–Warner Bros. Discovery deal.

Two days before the TechStock² article published, ShockYA! had already posted a detailed notice (Warner – Netflix Merger — Regulatory Stop Order) documenting an active judicial and regulatory inflection point and a formal request for a temporary regulatory STOP ORDER to preserve lawful oversight.

The omitted facts are material to investors and regulators because they concern judicial record fixation, evidence preservation, cross-border coordination, and the irreversibility risk of media consolidation before review is complete.

We respectfully request a correction, editor’s note, or updated disclosure.