As shoppers prepare to select their health insurance coverage starting this week, they are faced with rising costs, diminished assistance, and the uncertainties brought on by a potential government shutdown.

The enrollment period, which opens Saturday in nearly all states, provides millions of Americans their main opportunity to choose individual plans for 2026. However, this year’s process is steeped in political concerns as discussions concerning the extension of enhanced tax credits heat up.

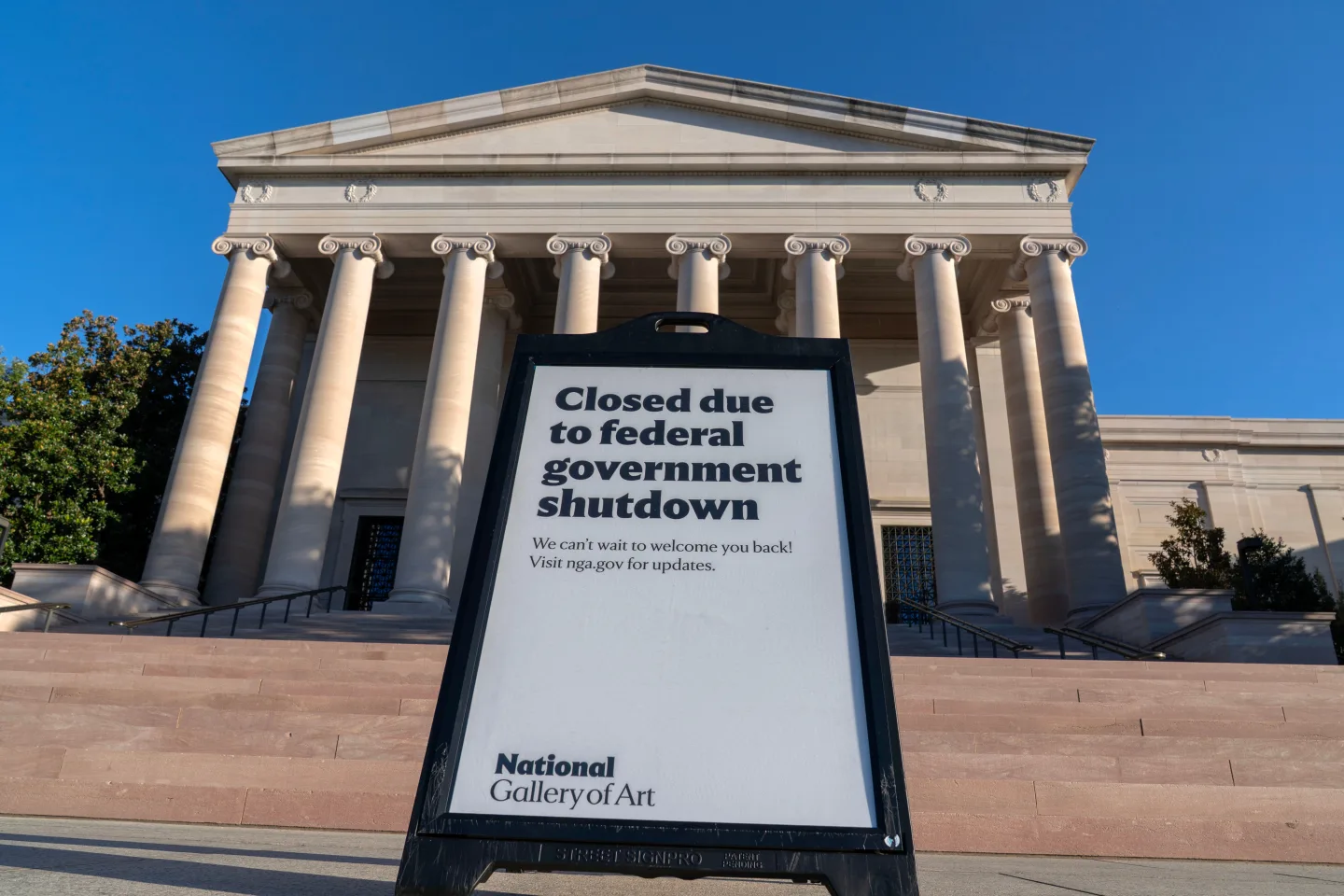

The federal government’s recent shutdown has stalled negotiations, leaving many individuals caught in the middle. With Democrats advocating for the continuation of subsidies helped by their administration during the pandemic, Republicans argue that negotiations cannot commence until the government is reopened.

Insurance experts warn that potential premium hikes could reach around 20% on average, with lack of funding for extra tax credits causing bills to nearly double for some shoppers. The increases stem partly from rising healthcare costs and insurers anticipating losing healthy customers who might refrain from re-enrolling.

Consequently, advocates are recommending that individuals begin exploring options immediately and not wait to see if new tax credits will be approved. Navigating the insurance market has been complicated further by a 90% funding cut for programs that assist consumers in finding coverage.

Shoppers are encouraged to visit healthcare.gov to understand available plans and complete applications for tax credits before making selections.

The Enrollment Deadlines Loom

While the general enrollment period lasts until January 15, individuals wanting coverage to begin on New Year’s Day must enroll by December 15. Last year, over 24 million Americans took advantage of individual health plans through insurance marketplaces connected to these tax credits.

To effectively assist individuals, remaining navigators or independent agents are available for help in understanding critical information regarding deductibles, network coverage, and prescriptions. As the enrollment deadline approaches, procrastination could lead to missed opportunities, emphasizing the need to act promptly.