The data suggests that the world's second-largest economy is demonstrating significant resilience, bolstered by strategic measures enacted by Beijing designed to support economic stability, coupled with a fragile trade ceasefire with Washington. A statement from China's National Bureau of Statistics noted that the economy has "withstood pressure and made steady improvement despite challenges."

Sector analysis indicates that manufacturing was a key driver of growth, recording a robust 6.4% expansion, fueled by heightened demand for modern technologies such as 3D printing, electric vehicles, and industrial automation equipment. The services sector, encompassing industries like transportation, finance, and technology, also saw positive developments, although the retail sector experienced a slowdown with growth diminishing to 4.8% in June from May's 6.4% figure.

Recent reports also indicate turmoil in the domestic property market, with new home prices declining at their fastest monthly rate in eight months, reflecting persistent struggles in the real estate sector despite Beijing's interventions aimed at stabilizing housing prices.

Economists had initially anticipated larger repercussions from tariff implementations on the Chinese economy; however, Gu Qingyang, an economist from the National University of Singapore, remarked on China's "high resilience." The growth was further propelled by exports as companies raced to propel shipments prior to any new tariffs or potential changes in export policies.

Looking forward, economists express uncertainty regarding the latter half of the fiscal year, with Prof. Gu suggesting that increased government stimulus may become necessary. Despite fears of missing the annual growth target of around 5%, some analysts, including Dan Wang from Eurasia Group, believe that the economy will not drop below a politically acceptable growth level of 4%.

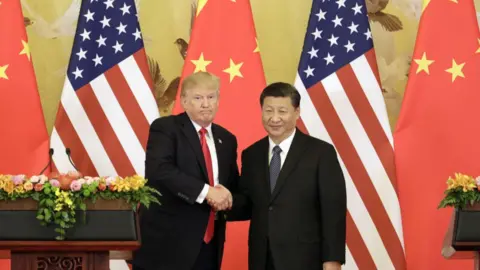

The ongoing trade tensions between China and the U.S. have led to tariffs of 145% on Chinese imports and a 125% levy on selected American goods in response. Recent negotiations in Geneva and London temporarily paused these tariffs, and both nations are now racing against a deadline of August 12 to finalize a long-term agreement, as Washington extends its tariff pressures on other nations with close economic ties to China.

Sector analysis indicates that manufacturing was a key driver of growth, recording a robust 6.4% expansion, fueled by heightened demand for modern technologies such as 3D printing, electric vehicles, and industrial automation equipment. The services sector, encompassing industries like transportation, finance, and technology, also saw positive developments, although the retail sector experienced a slowdown with growth diminishing to 4.8% in June from May's 6.4% figure.

Recent reports also indicate turmoil in the domestic property market, with new home prices declining at their fastest monthly rate in eight months, reflecting persistent struggles in the real estate sector despite Beijing's interventions aimed at stabilizing housing prices.

Economists had initially anticipated larger repercussions from tariff implementations on the Chinese economy; however, Gu Qingyang, an economist from the National University of Singapore, remarked on China's "high resilience." The growth was further propelled by exports as companies raced to propel shipments prior to any new tariffs or potential changes in export policies.

Looking forward, economists express uncertainty regarding the latter half of the fiscal year, with Prof. Gu suggesting that increased government stimulus may become necessary. Despite fears of missing the annual growth target of around 5%, some analysts, including Dan Wang from Eurasia Group, believe that the economy will not drop below a politically acceptable growth level of 4%.

The ongoing trade tensions between China and the U.S. have led to tariffs of 145% on Chinese imports and a 125% levy on selected American goods in response. Recent negotiations in Geneva and London temporarily paused these tariffs, and both nations are now racing against a deadline of August 12 to finalize a long-term agreement, as Washington extends its tariff pressures on other nations with close economic ties to China.