India's textile manufacturers are struggling as cheaper Chinese imports flood the market, threatening local production and increasing trade tensions.

India Faces Trade Dilemmas as Chinese Imports surge Amid Trump Tariffs

India Faces Trade Dilemmas as Chinese Imports surge Amid Trump Tariffs

Concerns rise over Chinese dumping as India’s textile industry slows down.

The vibrant textile industry in Tamil Nadu, India, is facing a severe downturn, with mill operator Thirunavkarsu reporting a drastic 40% drop in orders. The downturn is attributed to a surge in cheaper viscose yarn imports from China, which have dropped prices significantly—by 15 rupees ($0.18) per kilo—resulting in a backlog of unsold products in local mills.

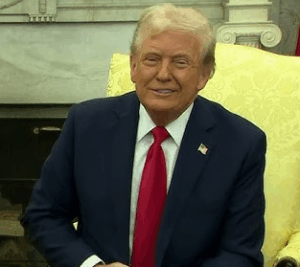

The situation has worsened as Chinese manufacturers, now seeking alternative markets due to U.S. tariffs imposed by former President Donald Trump—some as high as 145%—are reportedly “dumping” their products into Indian markets. This influx threatens local producers who already struggle with higher raw material costs.

Jagadesh Chandran from the South India Spinners Association warned that nearly 50 small spinning mills in areas like Pallipalayam, Karur, and Tirupur are winding down their operations, and many may be forced to shut down completely if the current trend continues.

Chinese Ambassador to India, Xu Feihong, has attempted to reassure Indian manufacturers, asserting that China will avoid market dumping practices and would prefer to boost imports of high-quality Indian goods. However, widespread concerns regarding Chinese dumping extend beyond textiles, as China's dominance in multiple sectors poses challenges for India's economy.

Reports indicate that in 2024, a record number of investigations against unfair Chinese imports were initiated, with nearly 200 complaints filed with the World Trade Organization (WTO), including 37 from India. The trade deficit with China has reached a staggering $100 billion, exacerbating India's dependency despite governmental plans to promote local industries.

In response, India's trade ministry is actively monitoring the situation and has even introduced a 12% safeguard duty on select steel imports to protect local manufacturers from Chinese competition.

Experts warn that India's attempts to bolster its own manufacturing through production-linked incentives have had limited success in reducing reliance on Chinese goods. Notably, even as global companies like Apple begin looking to India for assembly operations, India is still heavily dependent on Chinese components such as those involved in electronics, thus driving the trade deficit further.

Ajay Srivastava, founder of the Global Trade Research Initiative, highlighted this structural concern, suggesting that India's growing trade deficit is indicative of deeper economic issues that need to be addressed urgently.

With China now eyeing new trading partners post-Tariffs, Indian authorities must leverage this moment to initiate dialogue regarding its trade stance—particularly concerning the threat of dumping—to protect local industries effectively. As economic tensions simmer, India’s textile sector must navigate these challenges to ensure sustainability in a competitive global market.