Evergrande was once heralded as China's largest property developer, but following a staggering 99% decline in its market valuation, the company has been delisted from the Hong Kong exchange after 15 years of trading. This development shatters any lingering hope for a comeback, according to Dan Wang of the Eurasia Group, who stated, "Once delisted, there is no coming back."

Founded by Hui Ka Yan, Evergrande was once lauded as a success story, propelling Hui to the top of Asia's wealth rankings in 2017. That fortune has since dwindled from an estimated $45 billion to under $1 billion due to the company’s staggering financial mismanagement, including a $6.5 million fine for overstating revenues. Evergrande's collapse also raised alarms due to its vast liabilities, soaring to $300 billion, branding it the world's most indebted real estate company.

The crisis surrounding Evergrande, which included nearly 1,300 projects across 280 cities, has rippled through China's economy, largely responsible for widespread unemployment and economic stagnation. "The property slump has been the biggest drag on the economy," noted Wang, emphasizing how the sector's struggles exacerbate consumer spending challenges.

Additionally, heavy debts have prompted massive layoffs within the real estate sector, with many workers facing pay cuts, significantly affecting households that invested their savings in property. Housing prices have plummeted by at least 30% in some areas, further pressuring consumer confidence and expenditure.

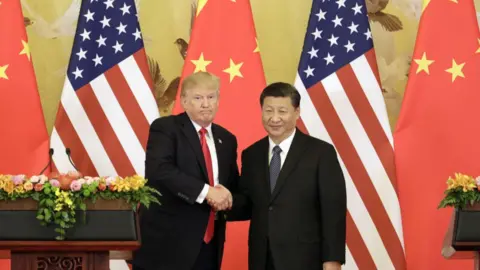

In a bid to stimulate the economy, Beijing has unveiled several initiatives aimed at reviving the housing market, yet the efficacy of these measures remains questionable. Despite over $300 billion funneled into the economy, growth has slowed to around 5%—a stark contrast to pre-crisis levels above 10%.

Experts express concern that the crisis is far from resolved, with additional developers like Country Garden facing similar turmoil. Goldman Sachs forecasted that property prices will continue to decline until 2027, indicating a prolonged recovery period ahead. As the government shifts focus from the traditional growth engine of real estate to high-tech industries, the path forward for China's housing market remains fraught with uncertainty.

Founded by Hui Ka Yan, Evergrande was once lauded as a success story, propelling Hui to the top of Asia's wealth rankings in 2017. That fortune has since dwindled from an estimated $45 billion to under $1 billion due to the company’s staggering financial mismanagement, including a $6.5 million fine for overstating revenues. Evergrande's collapse also raised alarms due to its vast liabilities, soaring to $300 billion, branding it the world's most indebted real estate company.

The crisis surrounding Evergrande, which included nearly 1,300 projects across 280 cities, has rippled through China's economy, largely responsible for widespread unemployment and economic stagnation. "The property slump has been the biggest drag on the economy," noted Wang, emphasizing how the sector's struggles exacerbate consumer spending challenges.

Additionally, heavy debts have prompted massive layoffs within the real estate sector, with many workers facing pay cuts, significantly affecting households that invested their savings in property. Housing prices have plummeted by at least 30% in some areas, further pressuring consumer confidence and expenditure.

In a bid to stimulate the economy, Beijing has unveiled several initiatives aimed at reviving the housing market, yet the efficacy of these measures remains questionable. Despite over $300 billion funneled into the economy, growth has slowed to around 5%—a stark contrast to pre-crisis levels above 10%.

Experts express concern that the crisis is far from resolved, with additional developers like Country Garden facing similar turmoil. Goldman Sachs forecasted that property prices will continue to decline until 2027, indicating a prolonged recovery period ahead. As the government shifts focus from the traditional growth engine of real estate to high-tech industries, the path forward for China's housing market remains fraught with uncertainty.