WASHINGTON — Bipartisan support in Congress is building around the extension of health insurance tax credits, a crucial measure that has vastly improved affordability for millions since the COVID-19 pandemic. But the situation is precarious, with the subsidies set to expire and lawmakers divided over the best course of action.

Democrats have threatened to cease support for government operations unless these subsidies are extended. Given the credits began in 2021 and were prolonged under previous Democratic control, the stakes are high for low- and middle-income individuals purchasing health coverage via the Affordable Care Act.

Interestingly, some Republicans, who once staunchly opposed the healthcare law, are now open to the idea of extending tax credits. They acknowledge the immediate threat of steep coverage hikes for many constituents if the subsidies lapse.

Despite some agreement on the need to act, major disagreements persist. While certain Republican leaders remain hesitant to commit to an extension, they are also contemplating potential modifications to the tax credit system, which could lengthen the overall resolution process and spark new debates.

As the debate unfolds, millions of Americans are poised to receive notifications about potential premium spikes, with some insurers estimating increases could be as substantial as 50%. Senate Democratic Leader Chuck Schumer has highlighted the urgency, stating that without congressional action, many Americans could soon face unaffordable insurance options.

Enrollment in ACA plans has surged to a record-high of 24 million, thanks largely to expanded subsidies. However, as expiration nears, constituents have already begun receiving alarming notices from insurers, prompting urgent calls for legislative action.

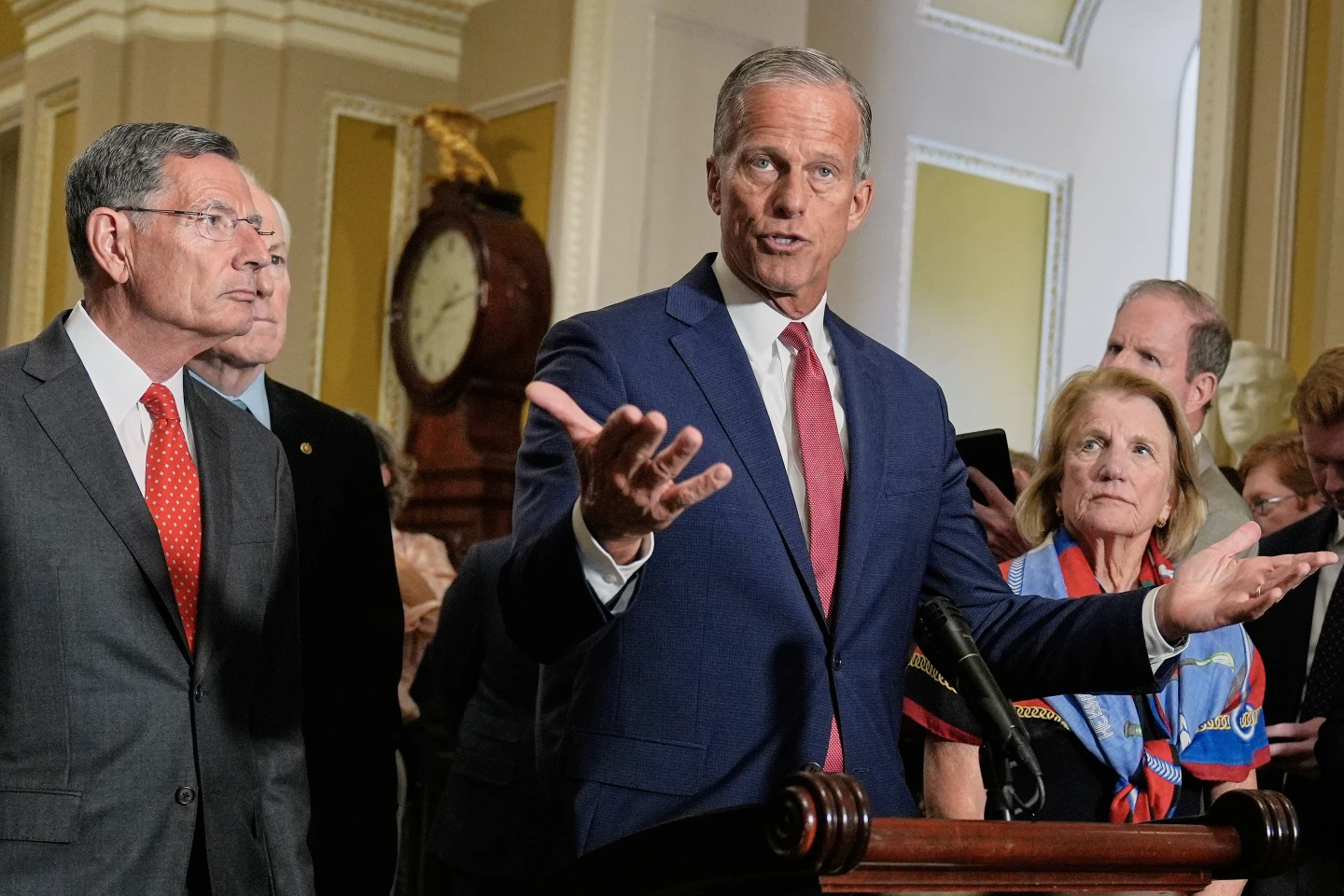

The larger context of a looming government shutdown complicates negotiations, pushing leaders into a tight corner. Senate Majority Leader John Thune has indicated the necessity for a clearer proposal from Democrats regarding subsidy extensions. With open enrollment set to begin on November 1, escalating pressures from both sides of the aisle suggest that any delays could hit American families hard.

Amidst calls for action, the political landscape remains fractured, with certain individuals advocating for changes while others resist outright extension. Upcoming weeks could see significant implications for both national policy and individual healthcare costs.